Welcome to Altitude, the bi-monthly drop from Cirrus Capital Partners. We write for founders and finance pros building at the highest level. Expect sharp insights, market movers, and operator-grade tips.

Consumer brands love to talk about Q4.

But the ones who outperform at the end of the year are scaling up in Q3—or they don’t scale at all.

This is the season where margin is either made or lost. And right now, from some conversations I’m having, it seems like too many founders are walking into a $2.6T holiday market with supply chains still stuck in reaction mode.

Retailers like Walmart and Target have already locked in October floor dates. Costco’s fall lineup is finalized. And yet many operators are still waiting on inventory funding, finalizing forecasts, or betting on September to "ramp."

It doesn’t work like that anymore.

Shelf space is being locked. Freight from China to LA just crossed $6,000. Most 3PLs are capping intake for peak season by early September. The timelines aren’t as flexible as some think. Q3 can’t be treated as a buffer period—it’s the build period.

Here’s what we’re seeing on the ground:

Ocean freight from China to the West Coast is up 41% YoY—and still climbing

Holiday POs at national retailers are due by mid-August in most categories

Top Shopify brands drive 60–80% of Q4 revenue in just 22 days

Most 3PLs are capping peak season intake by early September

Logistics are only half the equation. Capital timing is the other.

💡 Founder Tip: If your inventory strategy isn’t funded by August, your revenue potential is capped by default.

The illusion of October readiness

Every year, founders talk about “ramping in Q4.” But that ramp doesn’t exist. What you walk into October with is all you’ve got. The shipping cutoff has already passed. The product has already landed. Your marketing is either running against a full warehouse or it’s just burning cash.

BFCM isn’t a growth opportunity unless you’ve engineered it. And that engineering starts 60–90 days earlier.

Here’s what we’ve heard from operators in years past:

“We missed our reorder window and couldn’t restock until January.”

“Marketing crushed it—but we ran out of top SKUs mid-campaign.”

“We thought we were good, but our 3PL hit us with $40K in peak surcharges.”

Most brands assume October is still part of the planning window. But by then, your inventory is landed, your cash is deployed, and your warehouse capacity is either secured or full of someone else’s product.

The actual decisions that shape your revenue potential—MOQs, supplier timelines, fulfillment buffers—all hit cutoff by mid-Q3.

Capital strategy is operational strategy

This is the part many founders get wrong: They assume working capital is just for plugging holes. But when deployed proactively, it’s a competitive unlock.

We’re watching sharp operators use Q3 capital to:

Place aggressive POs now to hit MOQs and unlock volume-based discounts

Buy inventory with July pricing to hedge against Q4 cost inflation

Run overlapping test batches on new SKUs before peak season

Extend 90-day payment terms to retailers without cash strain

Taking on seasonal debt doesn’t have to be scary when it’s mapped to revenue. It can be a tool to effectively “buy confidence.” And in a category where stock outs mean silence, confidence is currency.

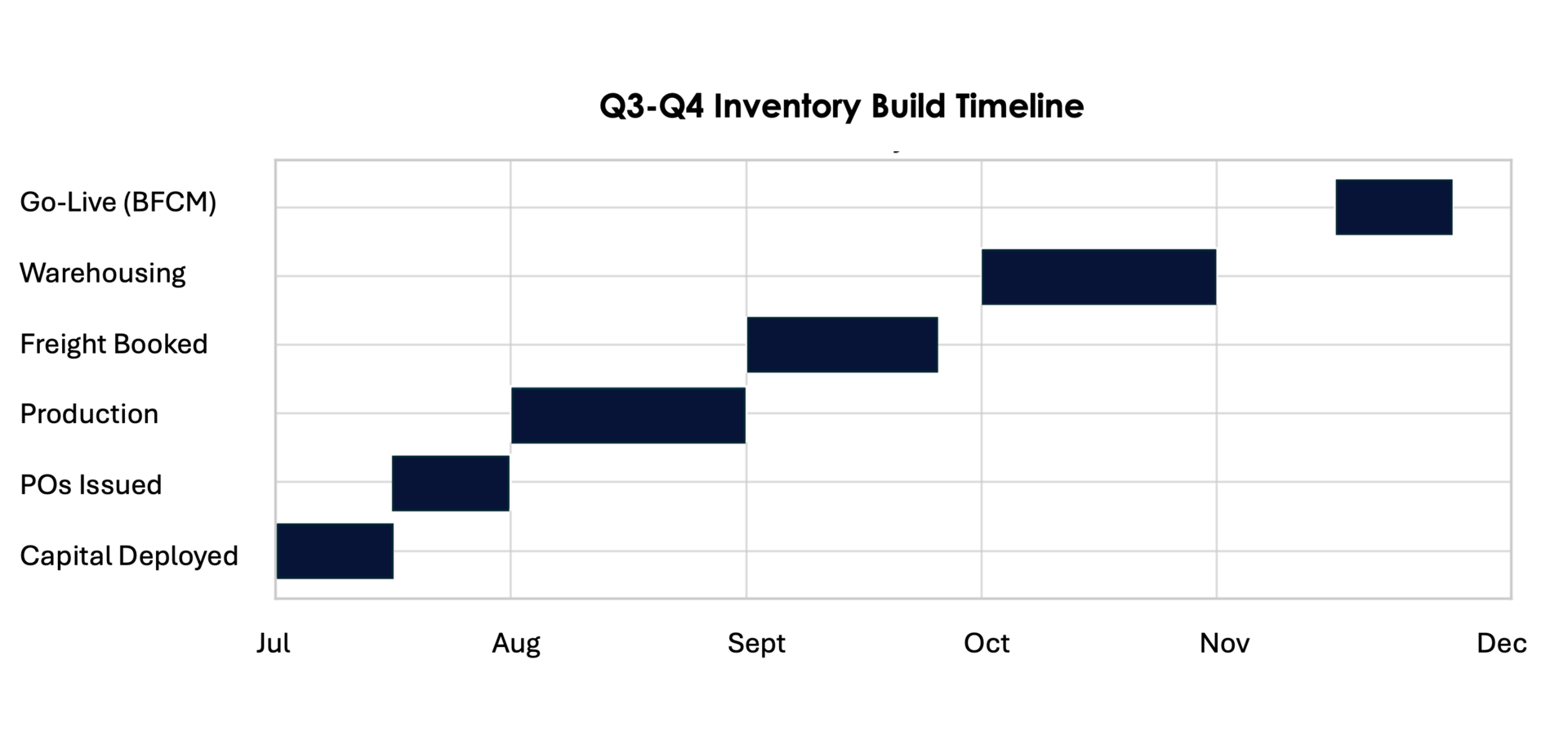

How should you execute in the lead-up to the holiday shopping spree? Capital deployed in July triggers a chain of non-negotiable deadlines across production, freight, and warehousing. Miss one, and the entire Q4 stack compresses. Get it right, and it’s a thing of beauty:

💡 Founder Tip: Your Q4 revenue ceiling was already set in motion last week. What you do now won’t just affect holiday volume—it’ll dictate how many retailer doors open in Q1.

With this in mind… seasonal success won’t come from perfect planning alone—it comes from preemptive decision-making.

And that’s where most founders get it wrong.

They think readiness is a demand problem. But more often, it’s a capital timing problem.

What seasonal readiness looks like

Most founders will say they’re “ready for Q4.” Few are.

Real readiness is about insulation.

Operators who crush Q4 are the ones who quietly made boring, disciplined decisions back in July:

They modeled both upside and downside demand scenarios.

They gamed out SKU shortages and padded fast movers with buffer.

They ran cash flow scenarios assuming worst case freight surcharges.

They booked warehouse space before peak intake cutoffs.

They secured capital early, when the market was still calm.

If even one of those isn’t dialed—you’re hoping, not planning. Because by the time Q4 gets loud, your options get narrow.

💡 Founder Tip: Retailers place bets early—and they place them on brands that prove they’re ready. Forecasts, landed inventory, and 3PL buffers are the price of admission.

And that’s the trap: most founders wait for demand signals. But seasonal scale doesn’t follow demand—it precedes it. It’s set in motion by supply chain moves made months earlier, not sales dashboards in October.

If you want breakout numbers when the market heats up, the real work happens when no one’s looking. Quiet, early, and under pressure. That’s when the Q4 stack is built.

Cirrus is helping brands secure $500K–$50M+ in flexible working capital to preempt the choke points. If you’re heading into a spike, let’s get you well-capitalized before the gates close.

What this means for founders

Founders need to internalize three real shifts:

Planning is now distribution. Brands who treat Q3 like a capital sprint are already too late. The best-positioned operators treat Q3 as a logistics discipline—planning not for ideal volume, but for system constraints: lead time, cash cycles, and fulfillment caps.

Debt fluency is a strategic skill. The founders with the strongest Q4 trajectory are the ones who understand capital instruments and match them to product velocity. Knowing when to deploy a line, when to float POs, and when to pad for SKU uncertainty is the new advantage.

Retail visibility is earned through readiness. Shelf space goes to the most dependable vendor. The ability to meet terms, absorb volume spikes, and show up in full earns retailer trust and next-year access. One shorted order now can lock you out for 12 months.

The emerging playbook favors:

→ Brands that model for constraint, not just aspiration

→ Founders who integrate capital timing into operations

→ Teams that sequence with discipline

Q4 is a test of your inputs. The ones who understand capital velocity, ops discipline, and margin preservation now will outperform in ways others can’t catch up to by November.

💬 Special Announcement:

Meet skuuu: AI-Powered Capital for CPG Founders

Cirrus is launching a new product built for one job: getting emerging consumer brands funded—fast and efficiently.

skuuu is an AI-enabled capital platform that matches brands with financing options from $50,000 to $5 Million, automating everything from “hello” to actual lender introductions.

Website going live next week! Keep an eye out.

Newsworthy Stories

1. Klarna enters B2B finance—proof that SMBs are starved for working capital. Klarna is now offering buy-now-pay-later terms to small businesses purchasing wholesale inventory. That’s a clear sign: demand for flexible, non-dilutive capital is spilling into new categories. Founders are looking for cashflow runway… not dilution.

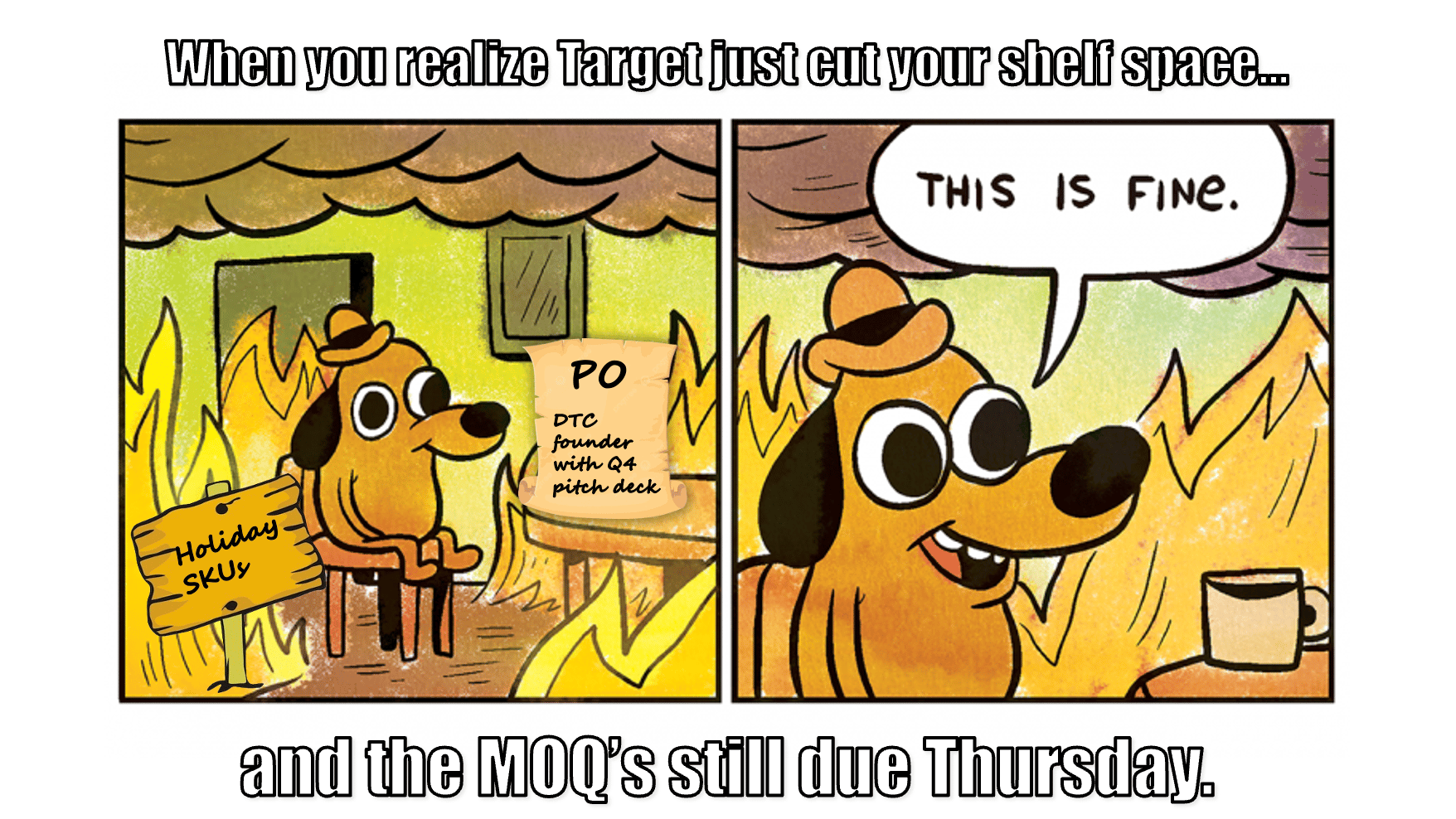

2. Target pulls back on discretionary—holiday shelf space just got tighter.

Target is trimming exposure to seasonal softlines and doubling down on essentials. Translation: unless you’ve got a clear velocity story and airtight margins, you're not making it onto shelves this year.

3. Ocean freight rates double YoY—your shipping costs just became a liability.

Freight from China to LA just topped $6,000 per 40-ft container—a two-year high. Red Sea risk, vessel backlogs, and pre-Q4 congestion are compounding. If you’re not already booked, you’re either paying 2x or getting bumped.

Founder Tips

📌 Inventory is a logistics issue and a narrative issue. Retail buyers, investors, and even your customers will judge your business by how confidently you handle stock. If your bestseller is out of stock in October, they don’t think, “bad timing.” They think, “not serious.” Simple as it seems, having a stocked shelf has to be part of your GTM strategy.

📌 More SKUs ≠ more growth. Every new SKU creates complexity: in cash flow, logistics, ad performance, and forecasting. If a product isn’t pulling its weight in velocity or margin, cut it. Growth comes from doubling down on what moves instead of diversifying into distractions.

📌 If your ops stack relies on the same 3 people every time something breaks, you’re not ready to scale. Founders often mistake speed for strength. But brittle systems under fast growth snap in Q4. Build infrastructure that survives absence before Q4 forces it.

Markets & Assets At-A-Glance

Asset / Market | Value | Vibe Check |

|---|---|---|

SOFR Rate | ~4.34 % | ⬇️ Slight dip from ~4.37 % earlier this week—hovering in low‑4 % terrain |

WSJ Prime Rate | 7.50 % | ⏸ Holding steady since Dec 2024 |

S&P 500 (SPY) | $6,297.36 | 📈 Near all-time highs; modest daily gains ~0.6% on strong earnings |

Nasdaq (QQQ) | $20,885.65 | 📈 Also approaching record highs; Nasdaq-led tech rally continues |

10‑Year Treasury Yield | ~4.46 % | 🔁 Slight pullback from 4.50 % range, now around 4.45–4.47 % |

Gold (spot per oz) | ≈ $3,334 | 🔁 Stable to soft—down ~0.4% today amid dollar strength |

Bitcoin (BTC) | ≈ $119,819 | 🔼 Trading near record highs, slight daily bump in mid‑$119 k |

Non‑Farm Payrolls | +147,000 (June) | 🔼 Cooling a bit, but still above expectations (consensus ~110k) |

US Unemployment Rate | 4.2 % | ⏸ Holding steady with previous reading |

Market Movers

Equity

Nvidia & AMD rally on resumed China chip exports. Following U.S. approval for AI chip exports (e.g. H20 chips), Nvidia surged ~5% and AMD jumped ~6.5%—a clear signal that geopolitical reprieves still move deeply leveraged semiconductor equities.

MicroStrategy spikes ~8-month high as bitcoin buys resume. MicroStrategy elevated its crypto commitment, purchasing over 4,200 BTC (~$472M), lifting the company’s stock to fresh highs. This move outpaced even BTC’s gains (~28.5% YTD) with a ~55% jump in the stock. A reminder: bold treasury plays still shift public narratives.

Wells Fargo down, JPMorgan mixed ahead of earnings. Banking earnings are setting the tone. Wells Fargo slid ~6.7% after disappointing net interest income, while JPMorgan beat estimates despite a ~17% dip in net profit

M&A

Ulta Beauty acquires Space NK. Ulta officially bought the U.K.’s premium beauty retailer Space NK this month, marking its first major move into the British market.

Waters buys BD’s flow‑cytometry business for $17.5B. Analytical-instrument leader Waters agreed to purchase Becton Dickinson’s biosciences unit this week.

Thoma Bravo to acquire Olo for ~$2B. Private equity powerhouse Thoma Bravo is buying restaurant‑tech platform Olo in a cash deal—signaling appetite for infrastructure exposed to digitization tailwinds

Credit

Allbirds secures $75M ABL facility from Second Avenue Capital. Supports expanded SKU count, inventory prep, and marketing reset heading into Q4. Accordion upsized to $100M. Pricing at SOFR + 575bps, maturity 2028.

Metalla Royalty & Streaming lands $40M revolver from BMO/NBF. Replaces $50M convertible loan. Reduces dilution, adds M&A capacity, includes accordion to $75M.Republic Business Credit backs defense supplier with $3.5M ABL + $500K term loan. Financing supports inventory and backlog conversion. PE-owned aerospace/defense manufacturer. Refi structure extends maturity and lowers leverage.

Recent Cirrus Term Sheets & Transactions

📄 $5M Delayed-Draw Term Loan | SaaS (MarTech)

We facilitated a $5M delayed-draw term loan for a fast-growing SaaS company in the marketing tech space.

Proceeds were used to refinance out of a more rigid ABL structure and support working capital and enterprise onboarding. Deal closed under tight timeline with strong execution on both sides.

📄 $1M Term Loan | Organic Food & Beverage Brand

We facilitated a $1M term loan for a fast-growing CPG brand in the organic food and beverage space.

The funds will support inventory purchasing ahead of a major retail rollout and refinance higher-interest debt with a smoother amortization schedule. This gives the team more breathing room to scale operations while staying in rhythm with demand.

Other recent term sheets and transactions through Cirrus:

» $25M senior credit facility for a specialty finance co. focused on SMB refinancings

» $10M acquisition term loan for a third-generation family distribution business

» $5M delayed-draw term loan facility for a consumer goods company in the beauty and haircare category

» $2M term loan for a staffing services and corporate training company

» $1M Term Loan for a growth-focused, residential services company

» $500K revolving line of credit for an enterprise SaaS and technical services company

Share the love!

“Don’t treat Q4 as a sprint—think of it as a supply chain exam you start studying for in July.”

Altitude is the #1 newsletter for founders, operators, dealmakers, and capital allocators aiming to reach their highest potential. Read alongside 3,500+ founders and professionals every other week. 🏔️

To your growth,

Ryan Ridgway, Founder & Managing Partner

Enjoying Altitude?

Connect with Ryan on LinkedIn for more insights on finance, strategy, and the future of capital.