Welcome to Altitude, the bi-monthly drop from Cirrus Capital Partners. We write for founders and finance pros building at the highest level. Expect sharp insights, market movers, and operator-grade tips.

Hi, quick FYI: we’re now putting Cirrus’ recent term sheets and transactions right at the top so you can scan deals fast, and then dive into the usual big-picture narrative below. Enjoy!

Recent Cirrus Term Sheets & Transactions

• $25M Senior Credit Facility. Structured for a specialty finance company focused on SMB debt refinancing.

• $10M Working Capital Facility. Provided to a California-based supplement company to support inventory and scale marketing.

• $10M Acquisition Term Loan. Financed the purchase of a third-generation distribution business in the logistics sector.

• $5M Delayed-Draw Term Loan. Extended to a fast-scaling beauty and haircare brand in the consumer goods sector

• $5M Delayed-Draw Term Loan. Structured for a high-growth MarTech SaaS to support revenue onboarding and GTM scale.

• $1.5M Delayed-Draw Term Loan. We facilitated a $1.5M delayed-draw term loan for a multi-location business in the recreational sports sector based in Hawaii.

• 1.3M Refinance Term Loan. We funded a $1.3M term loan for a residential and commercial painting company operating across the Carolinas.

What’s on my mind…

This week, three stories stand out in my mind: the rise of matcha as a wellness ritual, the cultural vacuum of “Brain-Rot Summer,” and gold’s unlikely turn as 2025’s hottest trade.

Each looks different on the surface, but they’re all teaching the same thing — value compounds when behavior, narrative, and scarcity line up.

Matcha’s Mainstream Glow-Up

Matcha has been around for centuries — whisked into Japanese tea ceremonies, valued for its earthy bitterness and caffeine kick.

But in 2025, it’s become more than a drink: it’s a ritual that millions of consumers broadcast daily on TikTok, Instagram, and in cafés from LA to London.

The numbers back it up: global matcha sales are projected to pass $5B by 2030, with Gen Z leading demand.

Starbucks has rolled it into seasonal menus. Boutique brands charge $8+ per latte for “ceremonial grade” powder. And in markets like New York and Seoul, you can’t walk a block without seeing a neon-green swirl on a café counter.

Why this matters: consumers are buying a signal of wellness and identity (just as Starbucks addicts buy brand and status). Matcha is framed as cleaner than coffee, slower than energy drinks, and more aesthetic than tea. That combination makes it sticky.

For operators, the lesson is:

Ritual + identity = margin

Consumer businesses that can build a cultural or wellness ritual into their product are shielded from commoditization.

Coffee is cheap. Matcha is a lifestyle. If you can position your product as a ritual worth showing off, you don’t need to spend big to win because your customers do the storytelling for you.

Brain-Rot Summer

Every summer used to have a defining cultural artifact. A hit song, a box-office juggernaut, a meme that tied together feeds from Seoul to São Paulo.

This year, so far, nothing has stuck. There’s been no anthem (that I’m aware of), no major blockbuster. We’ve just got a haze of sort of half-moments — “Coldplay-gate,” fleeting TikToks, scattered controversies that trended for 48 hours before vanishing.

And so, welcome to Brain-Rot Summer.

It seems like culture is splintering into thousands of micro-trends, but none powerful enough to dominate the collective attention span. Instead of monoculture, we now have what looks like “hyper-fragmented culture.”

Why this matters: For operators and founders, this might mean that you no longer need to chase mass-market appeal.

The age of monoculture demanded blockbuster budgets and dominant mindshare.

But the age of microculture rewards niche ownership. If you can own a corner of the hive mind — whether it’s wellness TikTok, an indie Discord, or a high-trust email list — you can compound faster than chasing the middle.

The strategy shift is actually pretty profound: stop aiming for “the big hit” and start cultivating micro-fandoms that self-reinforce.

it seems like attention is fractured, but that also makes it more ownable.

The lesson of 2025’s brain-rot summer, I think, is that niches are the new blue chips.

Gold’s Relentless Run

Gold was supposed to be boring. A relic from the 1980s, the stuff your uncle stashed away while he ranted about inflation…

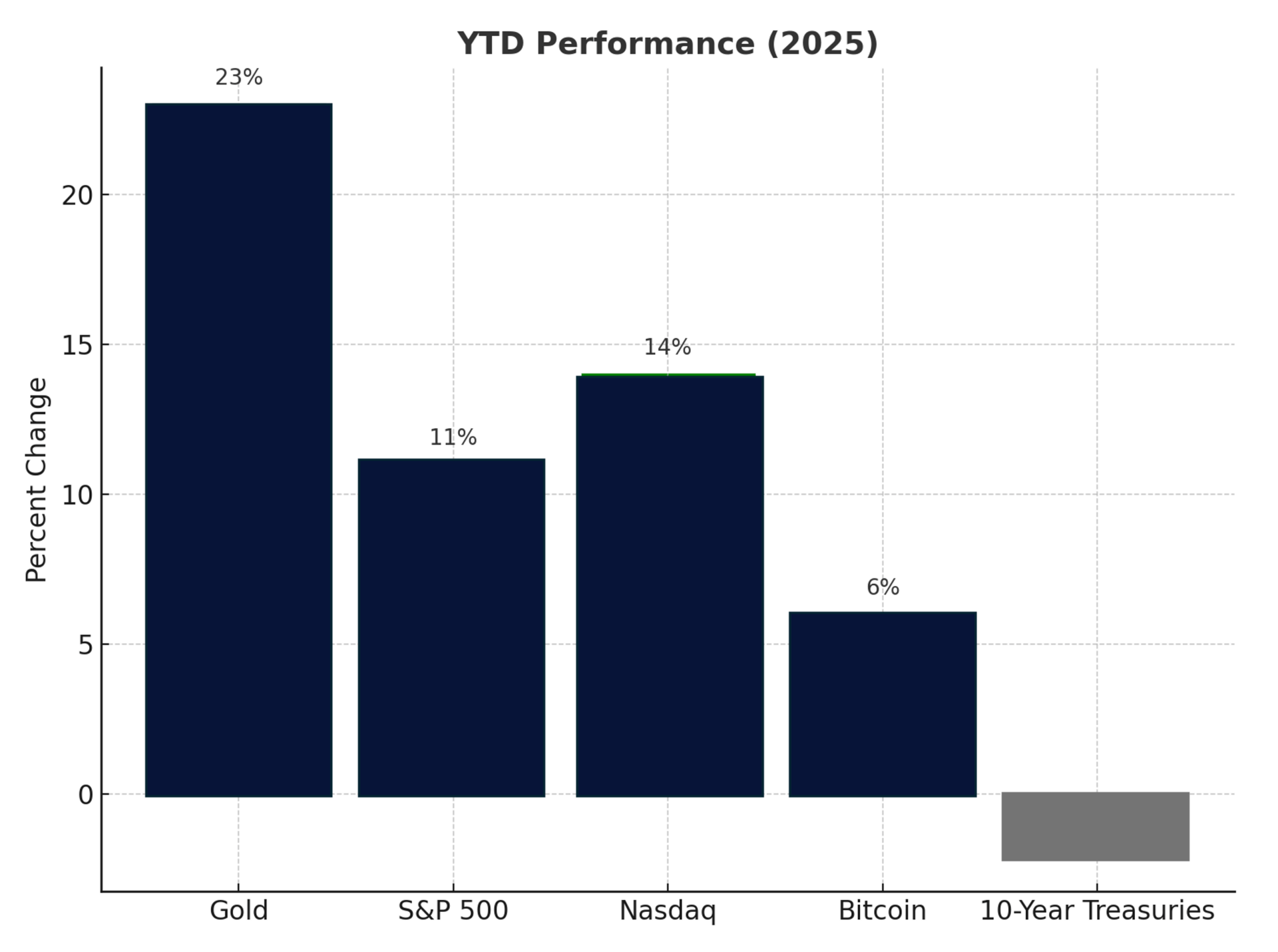

Yet in 2025, it’s turned into the best-performing major asset class — up 23% YTD, outpacing equities, bonds, and even Bitcoin.

This is structural:

Central banks: led by China, buyers added gold for 14 consecutive quarters. Official reserves stand near 2,300 tons, with whispers of far more off the books.

Macro backdrop: The dollar is weaker, real rates have plateaued, and geopolitics (Ukraine, Taiwan, Middle East) make gold the one hedge that isn’t someone else’s liability.

Culture: TikTok mini-bar unboxings, Dubai retailers posting record sales, Drake flashing a $4.5M chain. Gold isn’t just in vaults anymore — it’s back in culture.

Why this matters: gold has evolved from a reserve asset into a geopolitical bargaining chip and a status symbol.

For founders, the takeaway is this: when fundamentals and narrative click together, that’s when an asset (or a product) stops being stale and suddenly runs the table.

Your playbook:

Protect your “gold line” — the revenue stream that holds value no matter the cycle

Position at the intersection of multiple tailwinds (e.g., policy, culture, behavior)

Build trust because markets can’t be depended on to act rationally and nothing is more “golden” than the trust of your audience/customer base

In a year when risk assets were supposed to shine and safe havens were expected to drag, gold is doing both jobs at once. It’s outperforming growth and out-hedging the hedges.

In my opinion, markets still don’t know where to bucket this thing. Is it a commodity? A currency? A hedge? The answer is… yes, all at once. Which is why it has room to run.

Closing thought

Value compounds at the intersection of behavior, narrative, and scarcity.

Consumers broadcast their wellness rituals (always will), culture fragments into niches, and sovereigns pile into a 5,000-year-old hedge.

The surface looks chaotic. But underneath, it’s patterned. The edge comes from spotting these inflection points early. Rituals that feel niche today become billion-dollar markets tomorrow. A fractured cultural moment creates space for micro-brands to thrive. Even “boring” assets can roar when trust and story align.

The job of an operator is to catch these twists and turns and ride them with conviction.

Newsworthy Stories

1) Summer box office sputters, showing cracks in IP dominance. Hollywood’s August slate underperformed, with several $100M+ films missing projections. Analysts cite streaming fatigue, TikTok’s pull on attention, and declining loyalty to legacy franchises. Studios are scrambling for original content bets.

2) Paramount and Skydance Merger Crosses Finish Line. The strategic mega-merger combining Paramount Global and Skydance Media formally closed on August 7, creating the new Paramount Skydance Corporation. Wrapped in a $28 billion valuation, the deal brings deep ambitions to scale streaming, franchise IP, and film output. For founders, the restructured media giant may reshape content deal dynamics.

3) China Eyes Yuan-Backed Stablecoins to Boost Global Currency Reach. China is reportedly exploring the introduction of yuan-backed stablecoins — its first foray into digital currency issuance. The move is aimed at expanding the yuan’s footprint and offering an alternative to the dollar-dominated digital payments infrastructure. For businesses, this signals new geo-economic levers for trade and cross-border settlement.

Founder Tips

📌 Stack experiments across channels. Great founders layer multiple small tests at the same time so the data compounds quickly. Iteration speed, not campaign size, is what unlocks momentum.

📌 Treat distribution like a product feature. Build pathways to customers with the same care you build code or design. When distribution is designed in from day one, growth feels inevitable instead of forced.

📌 Upgrade your second-line leaders early. The faster you hand systems to capable lieutenants, the more leverage you create. Scaling happens when others can run playbooks without you in the room.

Markets & Assets At-A-Glance

Asset / Market | Value | Vibe Check |

|---|---|---|

SOFR Rate | ~4.36% | ⬇️ Slight dip from ~4.37% earlier this week hovering in low-4% terrain |

WSJ Prime Rate | 7.50% | ⏸ Holding steady since Dec 2024 |

S&P 500 (SPY) | $6,297.36 | 📈 Near all-time highs; modest daily gains ~0.6% on strong earnings |

Nasdaq (QQQ) | $20,885.65 | 📈 Also approaching record highs; Nasdaq-led tech rally continues |

10-Year Treasury Yield | ~4.46% | 🌥 Slight pullback from 4.50% range, now around 4.45–4.47% |

Gold (spot per oz) | ≈$3,334 | 🌑 Stable to soft, down ~0.4% today amid dollar strength |

Bitcoin (BTC) | ≈$119,819 | ⬆️ Trading near record highs, slight daily bump in mid-$119k |

Non-Farm Payrolls | +147,000 (June) | ⬆️ Cooling a bit, but still above expectations (consensus ~110k) |

US Unemployment Rate | 4.2% | ⏸ Holding steady with previous reading |

Market Movers

Equity

• Cohere raises US$500 million at a US$6.8 billion valuation to supercharge its AI agent push. Cohere secured a massive $500M financing round, valuing the company at $6.8B. The round was led by Radical Ventures and Inovia Capital. This is a declaration that AI agent infrastructure is moving to the enterprise mainstream.

• FieldAI pulls in $405 million to build “universal robot brains. FieldAI, a robotics startup, announced it raised $405M over two undisclosed rounds to develop foundational embodied AI — essentially imbuing robots with adaptable brains for varied environments. Backers include Khosla Ventures, Nvidia’s NVentures, Bezos Expeditions, Canaan Partners, and Intel Capital.

M&A

• Nexstar to buy Tegna for $6.2B. Nexstar Media Group announced a $6.2B takeover of broadcaster Tegna, creating a footprint covering ~80% of U.S. households. The move pushes FCC ownership limits and bets on consolidation as local TV fights digital ad giants.

• Soho House goes private in $2.7B deal. Members-only hospitality brand Soho House will be taken private in a $2.7B acquisition led by MCR Hotels, with Ashton Kutcher joining the board. Freed from public markets, the brand gains room to reset and expand its luxury experience model.

Credit

• Lulu’s closes $20M ABL facility with White Oak. Lulu’s Fashion Lounge secured a $20M asset-based revolver (plus $5M accordion) from White Oak Commercial Finance, refinancing ~$6M in prior debt and boosting liquidity.

• Lambda lands $275M facility led by J.P. Morgan. AI cloud startup Lambda raised a $275M senior secured facility, led by J.P. Morgan with Citi, MUFG, and Crédit Agricole, to expand GPU data center capacity.

Share the love!

“Build products people ritualize, communities that self-amplify, and systems that endure when attention shifts.”

— @RyanRidg

Altitude is the #1 newsletter for founders, operators, dealmakers, and capital allocators aiming to reach their highest potential. Read alongside 3,500+ founders and professionals every other week. 🏔️

To your growth,

Ryan Ridgway, Founder & Managing Partner

Enjoying Altitude?

Connect with Ryan on LinkedIn for more insights on finance, strategy, and the future of capital.