Welcome to Altitude, the bi-monthly drop from Cirrus Capital Partners. We write for founders and finance pros building at the highest level. Expect sharp insights, market movers, and operator-grade tips.

The next platform era is already unfolding. It’s happening quietly, unevenly, but with force.

You see it in how product teams are designing interfaces, how capital is flowing toward new mental models, and how a few companies are running plays that feel a little out of sync… until they aren’t.

Three moves over the last two weeks—by Google, Thinking Machines Lab, and Lime—offer a glimpse into how the terrain is actually shifting.

These are early architecture decisions for the next cycle.

1. Google’s XR push puts products inside physical movement

At I/O, Google rolled out Gemini-powered smart glasses with ambient overlays, AI navigation, and real-world shopping agents.

Nothing about the launch felt tentative. This is core product, woven into daily behavior.

Designing for screens is now a lagging strategy. Distribution starts inside motion. The apps that are earning attention are doing so by being useful in the flow of walking, talking, transacting—not by shouting through another push notification.

And so, proximity is becoming the new competitive layer.

Products that embed directly into how people move through space will feel native. Everything else will feel secondary.

2. Thinking Machines raised $2B to make autonomy the default behavior

This is Mira Murati’s first move post-OpenAI, and she’s not chasing interface polish or GPT wrappers.

She’s building systems that act without permission.

Products are evolving from helpers to operators. The best ones will manage complexity, make tradeoffs, and complete tasks without waiting for user input.

Founders who understand process structure will build products that do more per unit of attention—and win more surface area inside a workflow.

Interfaces used to matter most. Now it’s outcome density.

Increasingly, you don’t win by helping users click faster. You win by removing the need to click at all.

💡 Founder Tip: If your product still needs users to steer every decision, you're building software—not leverage. Build systems that collapse steps, compress context, and deliver value without hand-holding.

This marks a shift founders should take seriously. The next wave of enterprise value will likely not come from features that assist but from systems that operate independently and scale without oversight.

Teams that productize judgment (not just output) will capture more margin with fewer inputs.

And in a capital environment that rewards efficiency over excitement, autonomy is a massive multiplier.

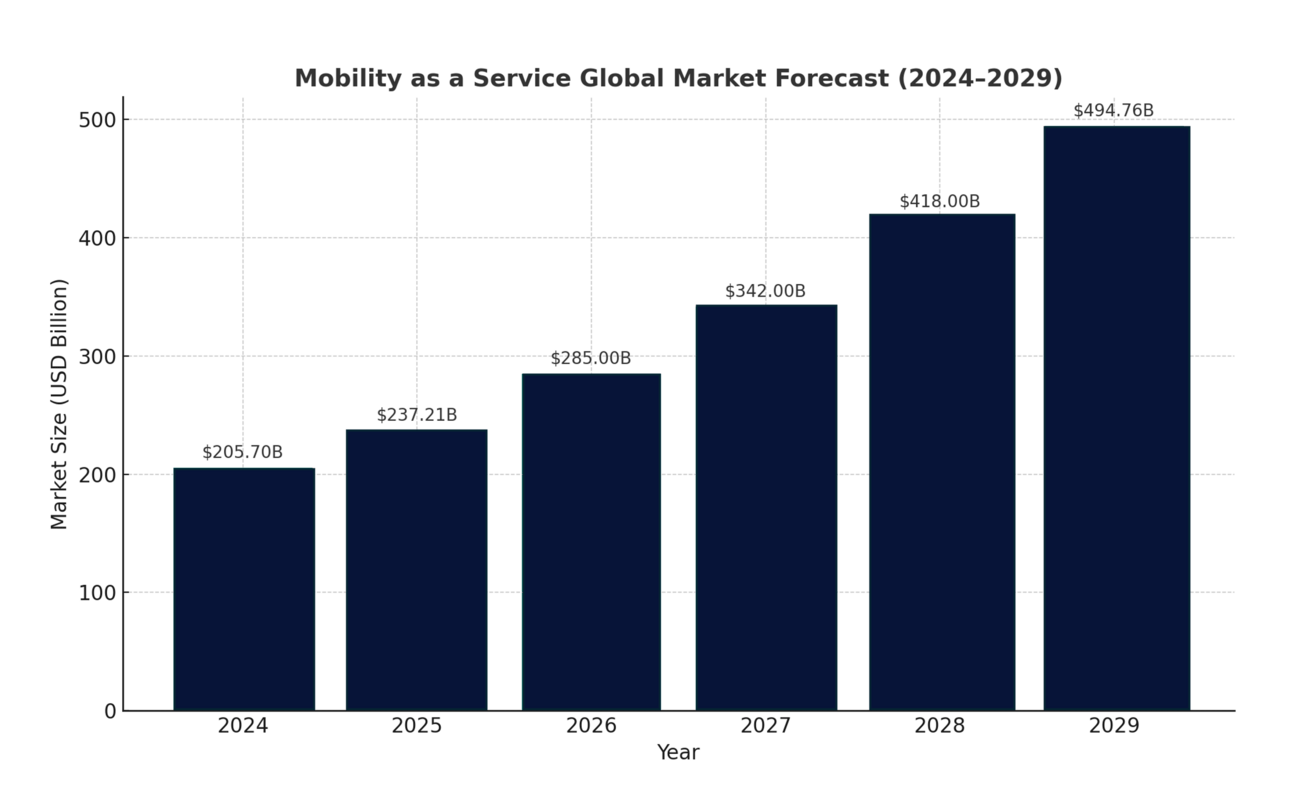

3. Lime’s IPO run is what consistency looks like in a market that reset

While most SaaS darlings are still juggling flat rounds and delayed raises, Lime—a hardware-heavy, city-regulated, weather-sensitive business—is preparing to go public.

Lime kept its margins clean, expanded with constraint, and treated the quiet period like it still mattered. That decision now reads as foresight. Teams that stayed ready are walking through re-opened doors while others are still polishing decks.

What we’re seeing is that markets haven’t thawed evenly. The ones moving forward are the ones that made discipline a default setting, not a performance indicator for investors.

While competitors chased reinvention, Lime doubled down on operational precision, regulatory navigation, and real-world logistics that compound over time.

This is what durable stewardship looks like: evolving a difficult business until it starts to resemble infrastructure.

If the IPO lands cleanly, Lime won’t just validate micromobility—it’ll redefine what disciplined execution looks like in a category most investors had written off.

As the market doubles by 2029, Lime’s IPO looks less like a gamble and more like good timing.

What to expect over the next decade

You’ll see software become invisible and invaluable.

The last ten years, interfaces were built to retain attention; over the next decade, they’ll be built to anticipate need.

So, don’t chase features. How can you encode function, judgment, and action directly into your business?

Entire departments will be replaced not by tools, but by agents that think, prioritize, and resolve. You already feel this happening.

Distribution will also shift into physical space. I think presence will matter more than polish—whoever embeds their product into the natural rhythm of how people move across space, roles, and states will own interaction by default.

Growth hacks are going out the door. Enter: the concept of “being the thing users never have to think about, because it’s always one step ahead.”

Capital will keep flowing, but with discipline as the filter.

You won’t be rewarded for velocity unless it’s paired with operating leverage. But if you keep pace, you’ll find the capital lines up behind you.

What this means for founders

Founders need to internalize three shifts:

1) Attention flows to products that show up in motion. Distribution has entered physical space. Interfaces are disappearing into context. The products that live inside real-world behavior—walks, conversations, transactions—will feel native. Screens are becoming a detour.

2) Autonomy beats usability. Tools that handle complexity on their own will outperform the ones waiting for input. When a product makes decisions, manages tradeoffs, and resolves workflows without supervision, it starts to feel essential. That kind of leverage scales cleanly.

3) Precision beats performance. The companies moving forward now are the ones that built with clarity, expanded with care, and stayed sharp without applause. That posture is earning them the right to lead again.

The playbook is tilting toward:

→ Products that execute autonomously and natively

→ Distribution and responsiveness that travels with users

→ Businesses that still scale under pressure

If you have rhythm, restraint, and reach, you can get a leg up in this market—and you can define whichever one comes next.

Newsworthy Stories

Synthflow AI raises $20M for real-time voice agents. Berlin-based Synthflow secured $20M Series A from Accel, bringing total funding to $30M. Their sub-400ms AI voice agents now serve 1,000+ enterprise clients, automating support and scheduling in real time. The line between bot and colleague is getting harder to draw.

Pano AI lands $44M to scale wildfire detection. Pano closed a $44M Series B to expand its AI-driven smoke detection system across 30M acres and 250 emergency agencies. The company uses panoramic cameras and ML to catch early signs and cut false alarms—bringing private innovation deeper into public safety infrastructure.

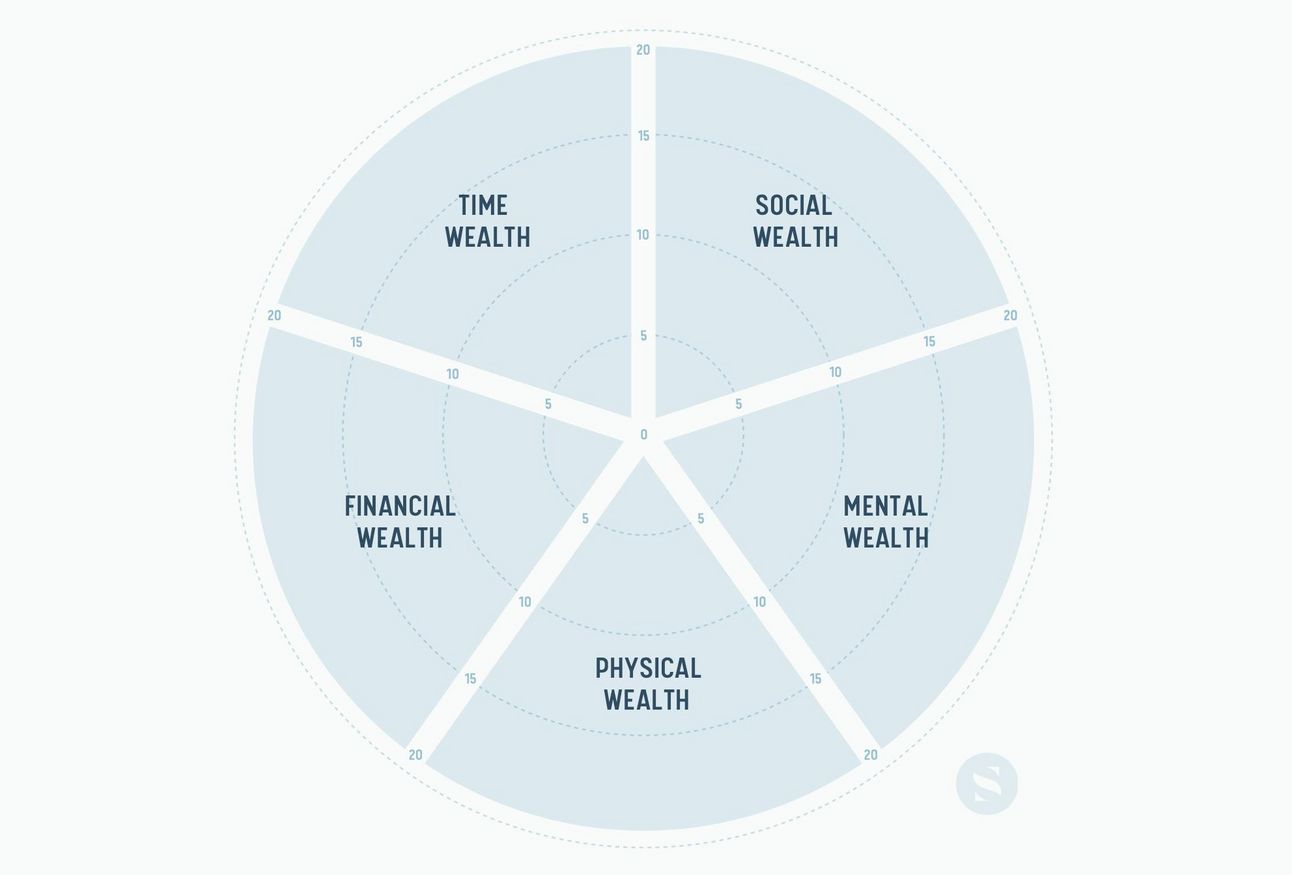

Sahil Bloom pushing new framework for founder productivity. A few months ago, Sahil rolled out “The 5 Types of Wealth” model.

The big takeaway = design systems that protect and compound these wealth types, which will turn productivity habits into exponential returns across personal and company performance.

Founder Tips

📌 Progress compounds when the product stops needing explanation. If your team still spends most of its time “context-setting,” you’re not there yet. Build features that speak fluently to the problem—and let the user recognize themselves instantly.

📌 Every distribution breakthrough starts with channel-model fit. A great product in the wrong lane gets ignored. Spend more time mapping where your customer actually makes decisions—and meet them there, not on your timeline.

📌 Operational discipline isn’t just for later stages. The best early-stage teams move like they’re public: clean books, tight metrics, measured hiring. When capital returns, the ones who treated the quiet period like it still mattered will be first in line.

Markets & Assets At-A-Glance

Asset / Market | Value | Vibe Check |

SOFR Rate | 4.45% | ↗️ Slight uptick (has been drifting near 4.4%) |

WSJ Prime Rate | 7.50% | ↔️ Holding steady |

S&P 500 | $617.65 | ➖ Slight pullback after June highs |

Nasdaq | $546.99 | ↘️ Mild drift down |

10‑Year Treasury | 4.26% | ↘️ Trending lower from recent peak around ~4.3% |

Gold (spot per oz) | ~$3,370 | ↔️ Firm (stable near recent levels) |

Bitcoin (BTC) | $105,445 | ↔️ Trading near recent highs |

Non‑Farm Payrolls | +139,000 | ↘️ Cooling, still in range |

US Unemployment Rate | 4.2% | ↔️ Sitting steady |

Market Movers

Equity

Cyngn stock surges 483% after Nvidia CEO Jensen Huang highlighted its use of the Isaac robotics platform. The sudden spike shows how a single executive shoutout can flip a business overnight.

Advent International moves on Spectris, recommending a £3.8 bn buyout with an 85% premium. This takeover highlights how undervalued UK tech assets are under pressure from deep-pocketed PE buyers.

M&A

Japan sets record M&A pace, with $232 bn in deals H1 2025 fueling a broader Asia rebound. Strong private equity deal activity signals return of confidence, especially among cross-border and domestic acquirers.

US deal volume climbs despite activity drop, according to LSEG—total deal value climbs 10% YoY, including Charter’s $22 bn Cox acquisition and a revived $8 bn Informatica buy by Salesforce.

Couchbase gets $1.5 bn buyout offer, sending shares up 30% on the announcement. The deal underscores continued appetite for infrastructure plays serving AI developers.

Credit

NPK International secures $150M revolving credit facility. NPK International entered a five‑year credit agreement closing June 20 for a $150M revolving credit facility (expandable to $250M via an accordion). Pricing is SOFR + 175–225 bps or Base Rate + 75–125 bps depending on leverage level.

Metalla Royalty & Streaming lands $40M revolver with accordion. On June 24, Metalla finalized a $40M USD revolving credit facility with BMO and National Bank Financial, with ability to increase to $75M. The refinanced facility replaces a $50M convertible loan, cuts dilution, and supports M&A-capable expansion.

Penguin Solutions refinances with $400M revolver, extends maturity to 2030. JPMorgan Chase led a $400M revolving credit refinancing for Penguin Solutions closed June 24, replacing a $300M term loan and $250M revolver due 2027. Penguin drew $100M immediately and paid down $200M in funded debt, reducing leverage and locking in SOFR + 1.75%

Recent Cirrus Term Sheets & Transactions

📄 $5M Delayed-Draw Term Loan | SaaS (MarTech)

We facilitated a $5M delayed-draw term loan for a fast-growing SaaS company in the marketing tech space.

Proceeds were used to refinance out of a more rigid ABL structure and support working capital and enterprise onboarding. Deal closed under tight timeline with strong execution on both sides.

📄 $4M Delayed-Draw Term Loan | Recreational Sports Brand

We closed a $4M delayed-draw facility ($3M funded upfront) for a leading operator in the recreational sports space.

Despite previous roadblocks across 50+ lenders, we secured multiple offers and structured the ideal solution. This unlocks better cash flow and positions the company for $100M+ in revenue.

📄 $1M Term Loan | Organic Food & Beverage Brand

We facilitated a $1M term loan for a fast-growing CPG brand in the organic food and beverage space.

The funds will support inventory purchasing ahead of a major retail rollout and refinance higher-interest debt with a smoother amortization schedule. This gives the team more breathing room to scale operations while staying in rhythm with demand.

And others from last quarter:

» $25M senior credit facility for a specialty finance co. focused on SMB refinancings

» $8M term loan with accordion for a private aircraft company focused on emergency services

» $5M delayed-draw term loan facility for a consumer goods company in the beauty and haircare category

» $2M term loan for a staffing services and corporate training company

» $1M Term Loan for a growth-focused, residential services company

» $500K growth term loan for an emergent EdTech company

Share the love!

“Proximity is a new competitive layer. Products that embed into how people move through space will feel native. Everything else will feel secondary.”

Altitude is the #1 newsletter for founders, operators, dealmakers, and capital allocators aiming to reach their highest potential. Read alongside 3,400+ founders and professionals every other week. 🏔️

To your growth,

Ryan Ridgway, Founder & Managing Partner

Enjoying Altitude?

Connect with Ryan on LinkedIn for more insights on finance, strategy, and the future of capital.