Welcome to Altitude, the bi-monthly drop from Cirrus Capital Partners. We write for founders and finance pros building at the highest level. Expect sharp insights, market movers, and operator-grade tips.

Recent Cirrus Term Sheets & Transactions

$25M Senior Credit Facility Structured for a specialty finance company focused on SMB lines of credit.

$10M Senior ABL Facility Structured for an emergent, high-growth supplement company.

$5M Senior ABL Facility > $10M Accordion Structured for a multinational foods company selling into key major retailers.

$2M Term Loan Structured for a high-growth company in the residential energy and home services sector.

$300K Term Loan Structured for an online education platform.

What’s on my mind…

The Trillion-Dollar Question

Corporate America has never seen anything like this.

Last week, Tesla shareholders approved the largest compensation package in human history. A $1 trillion incentive plan for Elon Musk. It’s the closest thing the public markets have ever had to a founder-king. The vote wasn’t a squeaker either. Retail investors swung it. Institutions balked, but the crowd carried it through.

The obvious story is the price tag. But the real story is what this vote says about power, incentives, and the structure of modern capitalism.

This was a referendum on who actually governs a company when the founder is the company.

Tesla shareholders were voting on belief. And that belief has now been priced at one trillion dollars.

The Founder as the Market

Here’s the uncomfortable truth nobody in governance circles wants to admit:

Tesla has crossed a psychological threshold where the founder isn’t evaluated on performance. The company is evaluated on his mythology.

Boards typically worry about concentration risk. Too much power in a CEO or too much dependence on a single executive. Too much opacity around key decisions. But Tesla inverted that logic. The company has concentrated its stability around one man’s ambition.

And that creates a market structure where:

• Musk is the moat

• Execution is identity

• Risk is the price of admission

Founders dream about this level of leverage. Boards fear it. Markets reward it… until they don’t. That’s why this story matters. It’s not about Musk. It’s about what happens when the power dynamics of a founder-led company break past traditional governance entirely.

This is the new playbook for late-stage operator-CEOs: if your narrative is strong enough, it becomes part of your balance sheet.

The scale of Musk’s new deal makes every prior payout look quaint. Here’s how it stacks up against the largest comp packages in corporate history:

Largest Executive Compensation Packages Ever

Executive | Package Value | Scenario |

|---|---|---|

Elon Musk (2025) | $1T | Projected, performance-based |

Elon Musk (2018) | $56B | Fully vested, stock milestones |

Adam Neumann (WeWork) | $1.7B | Realized exit/severance package |

Stephen Schwarzman | $1.39B | Realized IPO-linked equity |

Alex Karp (Palantir) | $1.1B | Stock-based IPO comp package |

Daniel Och (Och-Ziff) | $918.9M | Realized, IPO & fund performance |

When a trillion-dollar package gets waved through, it’s a sign that power is shifting from institutions to audiences.

A New Corporate Battleground

Tesla pulled off a 72% show of force. It was powered in large part by retail shareholders. About 42% of the company’s float sits in individual hands, nearly double the S&P 500 average. That’s not a cap table, that’s a movement.

Meanwhile, the institutional old guard — CalSTRS ($330B AUM), Glass Lewis, ISS — all voted no. They flagged dilution, precedent risk, and governance breakdowns. None of it mattered. The crowd had the numbers and the conviction.

Retail didn’t show up to debate equity comp theory. They showed up because they see Musk as the moat. The engine, the ethos, the only shot at chasing the full arc of the story. They're voting for continuity.

We've seen this energy before. GameStop was 60% retail during the peak. Bitcoin’s 88% non-institutional today. This is what narrative-backed capital looks like: high conviction, low coordination cost, zero chill.

Boards aren’t wired for this. Governance frameworks were built for quarterly check-ins and PDF decks, not meme-laced populism. But this is the new terrain.

Narrative gravity is a board-level force now. Companies that harness it will bend governance around them. Good luck keeping up.

Power, Incentives, and the Trillion-Dollar Trade

Let’s focus on the incentive structure itself for a moment.

A trillion-dollar package is absurd on its face. But it’s also revealing. Tesla is making a long-term bet that Musk’s incentives need to be pegged not to operational metrics, but to the theoretical outer boundary of what the company could become.

This is compensation as a strategic alignment mechanism, not as a reward.

The board is signaling:

“We want you tethered to this company’s destiny, not your other companies, not your other timelines, not your other obsessions.”

Whether that’s healthy is another debate. But strategically, it’s clear. Tesla believes its next chapter requires founder-level risk tolerance, aggression, and delusions of scale.

You don’t hire that energy. You incentivize it from within.

This is why the package is so large: not because a CEO deserves it, but because a movement requires it.

The Governance Stress Test Begins

Just like Deel’s espionage saga revealed what happens when growth outruns governance, the Tesla vote reveals what happens when governance outruns relevance.

Tesla’s board is optimizing for survival in a market where the company is synonymous with the person running it.

This is messy. It’s controversial. But it’s not irrational.

Here’s my takeaway:

Governance is no longer a set of rules. It’s a set of trade-offs. Companies at the edge of innovation will prioritize speed over structure, autonomy over accountability, and founder intuition over committee consensus. That doesn’t mean discipline will disappear. It means discipline shifts.

You can disagree with the trillion-dollar package. But you can’t deny the message:

Tesla is betting everything on the idea that founder power scales better than institutions.

The Macro Lens: What This Means for Markets

A move like this tells a story about the market (not just Tesla).

Big compensation packages usually come at the top of cycles or at moments when optimism exceeds gravity. When markets reward magnitude over prudence.

But this vote doesn’t feel like peak-cycle excess. It feels like a new stage of market psychology where:

• Frontier companies are valued on ambition

• Incentive structures look like venture bets

• Retail participation overwhelms institutional restraint

• The founder-ops archetype is back at full power

In a market fueled by AI, hardware, electrification, and infrastructure, investors are rewarding leaders who can bend entire industries — and punishing companies without narrative velocity.

This is the return of founder maximalism. The trillion-dollar package is the symbol.

What to Take Away

Whether you admire the decision or can’t believe it passed, the lessons are real:

• Narrative commands capital. When the story resonates, the market responds. Founders are now storytellers as much as operators.

• Retail moves with conviction. Individual investors are no longer sidelined—they’re organizing, voting, and reshaping corporate direction.

• Incentives define ambition. A trillion-dollar package signals to employees that this company plays at the edge of possibility.

• Boards are recalibrating. Traditional governance models are giving way to founder-led strategies that prioritize velocity and vision.

• Cohesion is the multiplier. The more audacious the mission, the more unified your shareholder base needs to be.

Tesla just turned the dial past 10. What happens next will define how far modern capitalism can stretch before it finds its limit.

What Caught My Eye This Week

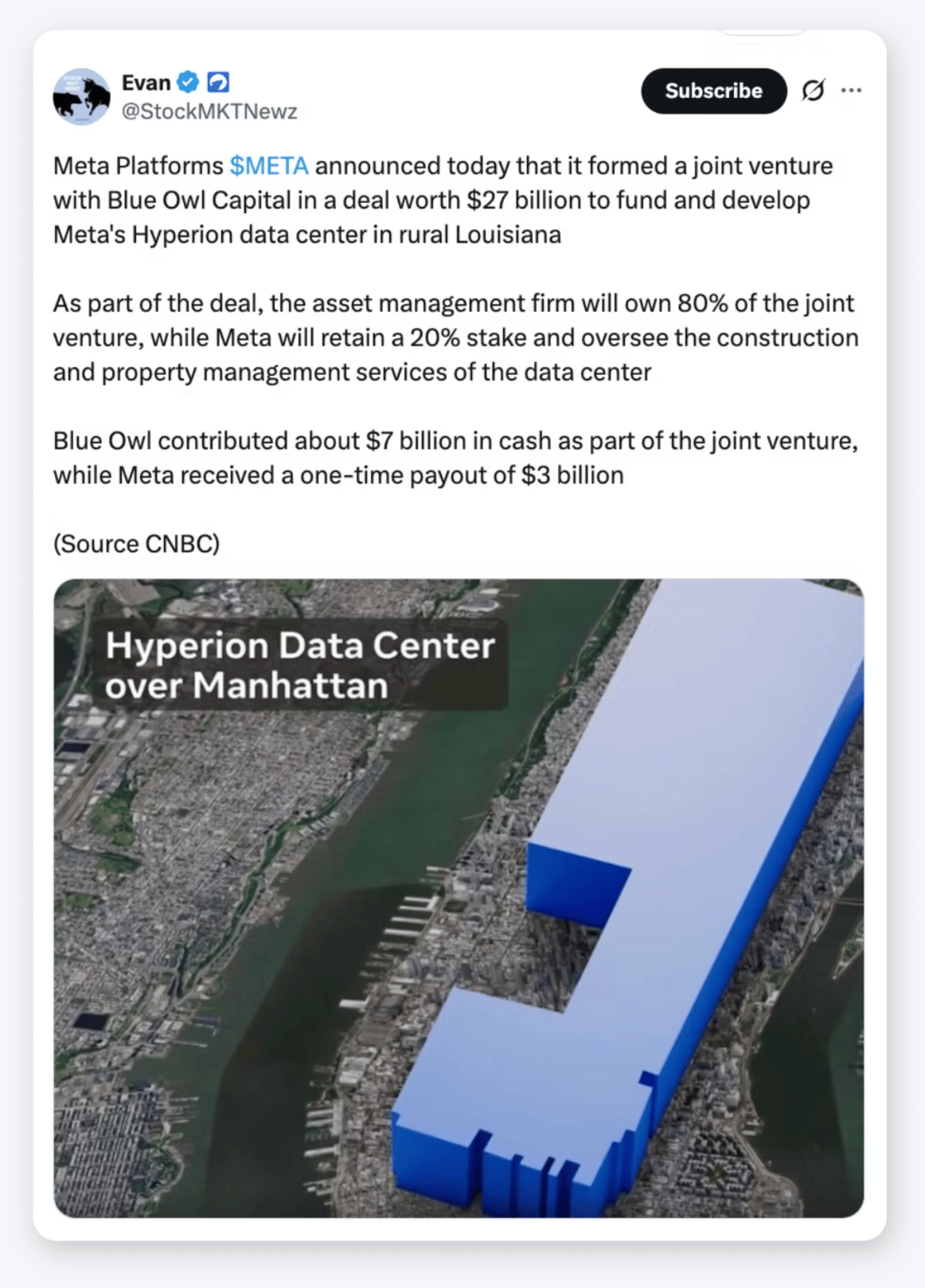

Meta’s $27B data center deal quietly reshaped capital markets

Meta formed a joint venture with Blue Owl Capital to fund its new Hyperion data center — offloading 80% ownership while retaining operational control. The $27 billion structure included $7B in cash from Blue Owl and a $3B payout to Meta, but the real shift was strategic: Meta turned hyperscale compute into a financial product.

Capital markets now treat data centers the way they treat buildings, ships, and rail: yield-generating infrastructure with long-duration utility.

AI infrastructure is becoming the real GDP engine

Barron’s flagged a shift hiding in plain sight: Q3 transcripts from major AI players are full of infrastructure speak — power draw, substation access, thermal thresholds. These aren’t software companies talking about margin. They’re utilities talking about load.

The AI economy now runs on megawatts. Energy, not engagement, is the constraint. Founders who understand that are building leverage. Everyone else is building latency.

Banks move first: lending spreads tighten after Fed cut

The Fed’s 25bps cut earlier this month brought rates to a 3-year low (now 3.75–4.00%). Within days, major banks compressed corporate lending spreads by 30–50bps — a synchronized move across JPMorgan, Citi, and BofA.

That kind of shift usually trails policy, not leads it. But this time, capital got there first. The move signals institutional appetite returning to risk-on assets: M&A, structured credit, and distressed buyouts.

Markets & Assets At-A-Glance

TL;DR

Markets remain near highs. Stocks steady, yields easing, gold cooling off, bitcoin slipping. Growth’s intact but the easy gains are gone.

Market Summary

Global risk assets remain fragile but resilient. U.S. equities sit near record highs as AI-driven capex and expected Fed cuts offset growing tariff and growth fears. Beneath the surface, leadership is rotating: investors are paring back expensive mega-cap tech while adding to cyclicals, financials, and value. Volatility has eased but remains elevated, reflecting a hedged, not euphoric, tape. The 10-year Treasury hovers around 4.1% with a modestly steepening curve as markets balance lower terminal-rate expectations against fiscal and tariff risk premia. Macro visibility is clouded by missing BLS labor data and noisy trade headlines. Crypto just endured a sharp liquidation but appears mid-cycle rather than systemic. The base case is still a soft landing, but stagflation and recession tails remain very much in play.

Goldman Sachs View – One-Line Bottom Line

Structurally bullish on U.S. innovation and AI productivity alpha, but tactically cautious — underweight expensive tech, overweight cyclicals and duration, keep crypto allocation tiny and hedged until the BLS fog clears and tariff headlines settle.

Asset / Market | Value | Vibe Check |

|---|---|---|

SOFR Rate | ~3.95% (overnight spot) | 🟢 Steady in the high 3’s to low 4’s; money-market pressure remains. |

WSJ Prime Rate | 7.00% | 🔻 Recent Q4 rate cut. |

S&P 500 Index | ~$6,839 | 🟢 Near recent highs; market momentum persists despite mixed earnings. |

Nasdaq Composite | ~$23,744 | 🟢 Similar to S&P — strong tech leadership, sideways overall. |

10-Year U.S. Treasury Yield | ~3.96–4.00% | 🔻 Yields slipping; bond bears watching potential rate-cut path. |

Gold (spot per oz) | ~$4,203 | 🔻 After a parabolic run, gold sees a minor pullback that’s likely temporary. |

Bitcoin (BTC) | ~$92,364 | 🔻 Down approx 13% on the trailing month; crypto momentum fades amid macro uncertainty. |

Non-Farm Payrolls (U.S.) | +22,000 (Aug) | 🟡 Labor market steady but decelerating. |

U.S. Unemployment Rate | ~4.3% | 🟢 Slight uptick month-over-month; still historically low. |

Market Movers

Equity / Fundraises

Hippocratic AI raises $126M Series C to scale autonomous clinical agents. Investors are doubling down on health-AI. The round shows where capital wants to flow — into vertical AI with real operational stakes, not broad-stroke “AI for everything” plays.

M&A (Big Buys / Strategic Deals)

Pfizer’s acquired Metsera, a clinical-stage biotech developing obesity and diabetes treatments for around $10 billion. It came after winning a fierce bidding war against Novo Nordisk. Now Pfizer has a promising once-monthly GLP-1 injection (MET-097i) in late-stage trials that could become a competitor to Novo Nordisk’s Wegovy and Eli Lilly’s ZepBound if approved.

Credit / Financing / Other Moves

Meta closes a $27B private-credit mega-deal to fund hyperscale data centers.

BlackRock, Pimco, and Citadel turned data-center buildout into a liquid credit product, and the market treated it like investment-grade infrastructure overnight. This is how AI goes from hype-cycle to capital-markets staple.

Eclipse Business Capital upsizes its senior facility to $2.355B. The move, agented by Wells Fargo and backed by a syndicate of major banks, reflects increasing credit appetite across the ABL sector.

Cornerstone Financing secures up to $1B from Fortress. The commitment supports CHEIFS, its innovative home equity platform. This signals private credit’s continued expansion into non-traditional asset classes.

News from Cirrus

Last month, I attended the Inc. 5000 conference in Phoenix, joining hundreds of fellow fastest-growing companies in the U.S.

It was a sharp pulse-check on what high-growth founders are prioritizing heading into 2026. Best session was Jay Shetty’s keynote on scaling alignment. 3 big takeaways:

Being fast-growing doesn’t mean being fully built. Founders talked less about exits and more about second acts. Scale sometimes exposes cracks.

Brand is conviction. Leaders like Taraji P. Henson and poppi’s team were doubling down on identity, culture, and customer resonance as their moat.

The biggest unlocks came from unsexy things. Panels on capital efficiency, HR compliance, and back-office tech were packed.

Share the love!

This is founder maximalism at full throttle. A trillion-dollar comp vote marks a shift in how power works. It’s not just about Musk.

Retail carried the decision. Institutions got sidelined. And Tesla proved that in 2025, conviction > governance.

— @RyanRidg

Altitude is the #1 newsletter for founders, operators, dealmakers, and capital allocators aiming to reach their highest potential. Read alongside 4,000+ founders and professionals every other week. 🏔️

To your growth,

Ryan Ridgway, Founder & Managing Partner

Enjoying Altitude?

Connect with Ryan on LinkedIn for more insights on finance, strategy, and the future of capital.